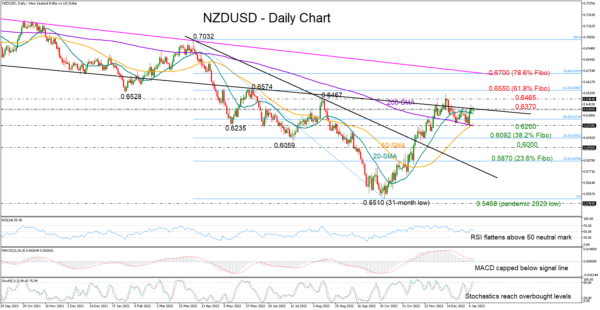

NZDUSD got trapped around 0.6370 immediately after the bounce on the 50- and 200-day simple moving averages (SMAs) at 0.6200. Interestingly, the congestion is developing around the lower boundary of the broken 2021-2022 bearish channel.

While the bullish SMA crosses flag a resumption of the latest upleg, the momentum indicators are still reflecting some caution. Although above its 50 neutral mark, the RSI is struggling to gain impetus, while the MACD remains capped below its red signal line. Moreover, the stochastics are already flirting with overbought levels, increasing the risk for a downside correction in the short term.

If buyers breach the 0.6370 threshold, the price may advance straight up to the key barricade of 0.6465. The 61.8% Fibonacci retracement of the 0.7032-0.5510 downleg is slightly higher at 0.6550 and may attract some attention before the focus shifts to the channel’s tough resistance trendline at 0.6700 coming from the March 2021 peak. A successful violation of that bar could spark a new rally.

On the downside, a close below the 20-day SMA could bring the 0.6200 region back under the spotlight. If selling forces intensify, the next destination might be the 38.2% Fibonacci support zone of 0.6092. Even lower, a break below the 0.6000 psychological mark is expected to squeeze the pair forcefully towards the 23.6% Fibonacci of 0.5870. Note that the descending trendline drawn from April’s high of 0.7032 is positioned around the same area.

In brief, market sentiment is fragile in NZDUSD. A sustainable move above 0.6370 is required to raise fresh buying interest. Otherwise, the pair may drift lower to find fresh support.