Hello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of CHFJPY published in members area of the website. Recently the pair made short term recovery against the 148.53 8 peak that has unfolded as Elliott Wave Double Three Pattern. It made clear 7 swings from the lows and completed at the Blue Box ( selling zone) . In further text we’re going to explain the Elliott Wave pattern and trading setup

Before we take a look at the real market example, let’s explain Elliott Wave Double Three pattern.

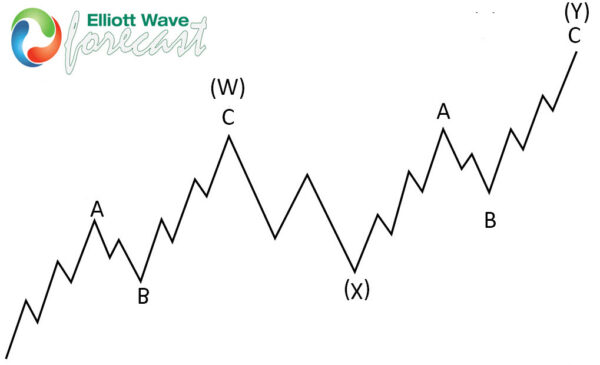

Elliott Wave Double Three Pattern

Double three is the common pattern in the market , also known as 7 swing structure. It’s a reliable pattern which is giving us good trading entries with clearly defined invalidation levels.

The picture below presents what Elliott Wave Double Three pattern looks like. It has (W),(X),(Y) labeling and 3,3,3 inner structure, which means all of these 3 legs are corrective sequences. Each (W) and (Y) are made of 3 swings , they’re having A,B,C structure in lower degree, or alternatively they can have W,X,Y labeling.

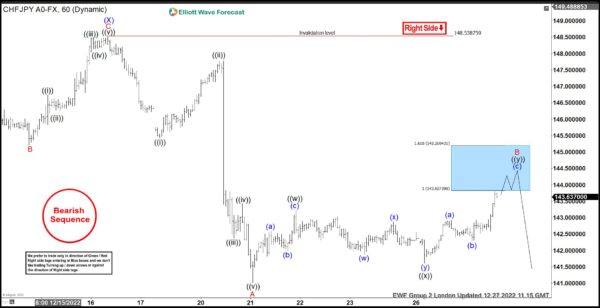

CHFJPY 1h Hour Elliott Wave Analysis 12.27.2022

CHFJPY is giving us B red recovery against the 148.538 peak. Correction is unfolding as Elliott Wave Double Three Pattern with ((w))((x))((y)) black inner labeling. We can see that each leg has corrective sequences. Price structure already shows 7 swings and the pair is reaching extreme zone : 143.82-145.20. That area is marked as a Blue Box on the chart and that is our selling zone. At the marked area buyers should be ideally taking profits and sellers can appear again. Consequently , we expect to see reaction from the marked area. From mentioned zone we can get either decline toward new lows or larger 3 waves pull back at least. Once pull back reaches 50 Fibs against the ((x)) black low, we will make short position risk free ( put SL at BE) and take partial profits. Break of 1.618 fib extension: 145.2 would invalidated the trade.

CHFJPY 1h Hour Elliott Wave Analysis 1.3.2023

The pair found sellers right at the blue box and made decline from there toward new lows. As a result, members who took short trades mad positions risk free . ( Put SL at BE) and took partial profits. At this stage we see the pair remains bearish against the 144.91 pivot. Decline from the peak looks to be unfolding as 5 waves. As soon as the cycle completes we expect to see correction against the 144.91 peak. As far as the price stays above that level, and that pivot holds more downside can be seen in the pair once expected bounce completes.