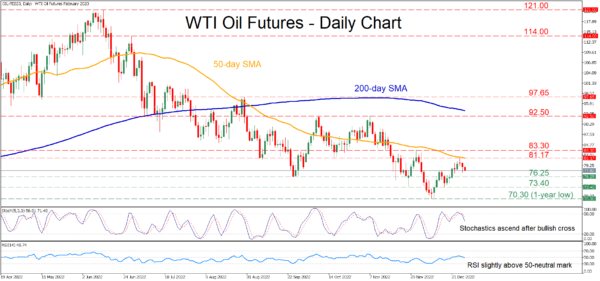

WTI oil futures (February delivery) have been stuck in a downtrend since June but managed to bounce at the one-year low of 70.30 and recoup some losses. However, this recovery proved to be short-lived after the 50-day simple moving average (SMA) curbed the commodity’s upside.

The momentum indicators currently suggest that bearish forces have gained the upper hand. Specifically, the RSI has fallen below its 50-neutral mark, while the stochastic oscillator is sloping downwards after exiting the 80-overbought territory.

An extension of the recent pullback could shift the focus to the September low of 76.25. Sliding beneath that floor, the price could descend to test the 73.40 barrier. A break below that zone could open the door for the one-year low of 70.30.

Alternatively, if buyers re-emerge and seize control, oil futures could move higher to challenge the recent rejection point of 81.17, which overlaps with the 50-day SMA. Conquering this barricade, the bulls might then aim at 83.30 before the November high of 92.50 comes under examination. Surpassing the latter, the price could encounter strong resistance at the August peak of 97.65.

In brief, the short-term technical picture has deteriorated again for WTI oil futures since their latest advance came to a halt. For that bearish sentiment to alter, the price needs to profoundly jump above the 50-day SMA.