Key Highlights

- EUR/USD started a short-term downside correction from the 1.0735 zone.

- It traded below a key bullish trend line with support at 1.0605 on the 4-hours chart.

- GBP/USD corrected lower below the 1.2200 support zone.

- Oil price is eyeing an upside break above the $80 resistance zone.

EUR/USD Technical Analysis

The Euro started a decent increase above the 1.0500 level against the US Dollar. EUR/USD even climbed above the 1.0650 level before the bears appeared.

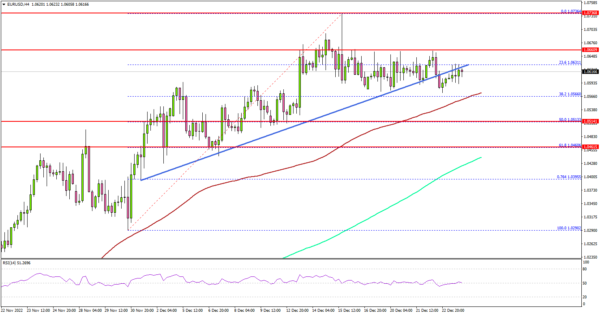

Looking at the 4-hours chart, the pair traded as high as 1.0736 before there was a downside correction. There was a minor decline below the 1.0650 support. There was also a break below a key bullish trend line with support at 1.0605 on the same chart.

The pair traded below the 23.6% Fib retracement level of the upward move from the 1.0290 swing low to 1.0736 high. It is now consolidating near the 1.0600 zone.

On the downside, there is a decent support forming near the 1.0570 zone and the 100 simple moving average (red, 4-hours). The next major support is near the 1.0520 zone or the 50% Fib retracement level of the upward move from the 1.0290 swing low to 1.0736 high.

A downside break below the 1.0520 zone might send the pair towards the 1.0450 level. Any more losses might open the doors for a move towards the 1.0400 support zone.

On the upside, an initial resistance is near the 1.0630 level. The next major resistance may perhaps be near 1.0650. A clear move above the 1.0650 resistance might start a steady increase.

In the stated case, EUR/USD may perhaps rise towards the 1.0700 level. Any more gains could lead the pair towards the 1.0750 resistance zone or the 1.0800 level.

Looking at crude oil price, the bulls seem to be in control and there are chances of more upsides abov the $80.00 resistance zone.

Economic Releases

- US Housing Price Index for Oct 2022 (MoM) – Forecast +0.8%, versus +0.1% previous.

- US Wholesale Inventories for Nov 2022 (preliminary) – Forecast +0.7%, versus +0.5% previous.