Key Highlights

- USD/JPY found support near the 130.55 zone and corrected higher.

- It could struggle near the 134.00 resistance zone on the 4-hours chart.

- The US GDP grew 3.2% in Q3 2022, better than the market forecast (2.9%).

- Gold price failed to clear the $1,825 resistance and corrected lower.

USD/JPY Technical Analysis

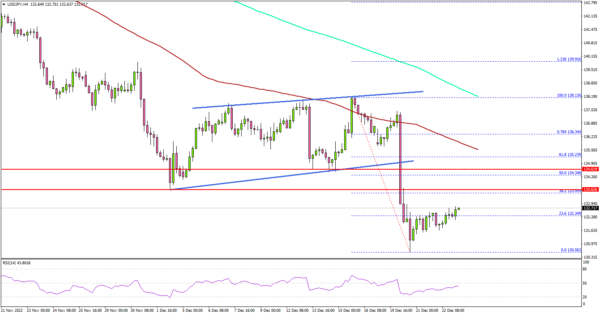

The US Dollar started another decline from the 138.00 resistance zone against the Japanese Yen. USD/JPY declined heavily after it broke the 136.80 support.

Looking at the 4-hours chart, the pair traded below a key rising channel with support near 135.00. There was a close below the 135.00 level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

The pair traded as low as 130.56. Recently, the pair started an upside correction above the 131.20 level. There was a positive wave after the US GDP report was released, which exceeded the market forecast with a growth rate of 3.2% in Q3 2022.

On the upside, an initial resistance is near the 133.50 level. The next major resistance may perhaps be near 134.00. A clear move above the 134.00 resistance might start a steady increase.

In the stated case, USD/JPY may perhaps rise towards the 135.00 level. Any more gains could lead the pair towards the 135.50 resistance zone or the 100 simple moving average (red, 4-hours).

On the downside, there is a decent support forming near the 131.00 zone. The next major support is near the 130.50 zone, below which the pair might dive towards the 128.80 level. Any more losses might open the doors for a move towards the 126.50 support zone.

Looking at gold price, there was another rejection near the $1,825 resistance zone. It has opened the doors for a move towards the $1,780 level.

Economic Releases

- US Personal Income for Nov 2022 (MoM) – Forecast +0.2%, versus +0.7% previous.

- US Durable Goods Orders for Nov 2022 – Forecast -0.6% versus +1.1% previous.

- US Nondefense Capital Goods Orders Ex Aircraft for Nov 2022 – Forecast 0% versus +0.6% previous.