The yellow metal dropped significantly in the yesterday’s trading session and reached new lows. Price changed little today, but maintains a bearish bias on the short term. Gold is trading right above an important dynamic support, a valid breakdown will announce a further drop.

The price is into a corrective phase as the USDX has finally managed to rebound on the short term. Gold should drop further if the USDX’s breakout above the 93.81 will be validated. The greenback is expected to dominate the currency market in the upcoming period if the United States data will come in better today as well.

The economic calendar is filled with high impact data, the US Unemployment Rate is expected to remain steady at 4.4% for the second month in September, while the Average Hourly Earnings could increase by 0.3%, more versus the 0.1% in the former reading period. Moreover, the NFP will be released as well and is expected to be reported at 82K. You should keep an eye on the economic calendar to see what will move the price.

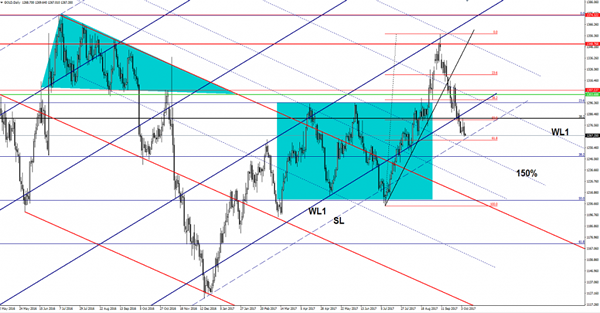

Gold dropped much below the $1270 per ounce and is almost to reach the sliding line (SL) of the ascending pitchfork, where he may find support again. Support can be found at the 61.8% retracement level. However, a breakdown below the mentioned support levels will confirm a reversal on the short term and a drop much below the $1250 per ounce.