Gold sustained a muted tone during Monday’s early European trading hours, consolidating its latest spike around the August resistance territory and the 1,800 level despite inching to a new high of 1,809.

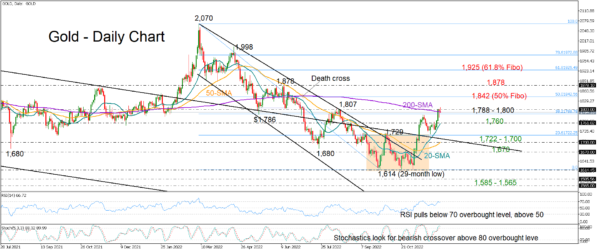

Overbought signals become more evident as the RSI weakens below 70, while the stochastics look for a bearish crossover above 80. Yet, sellers may not take action, unless the 38.2% Fibonacci retracement of the 2,070–1,614 downleg at 1,788, which was a key barrier to downside movements during previous months, proves fragile. Should the price drop below that base, the 20-day simple moving average (SMA) may immediately add a strong footing around 1,760. Failure to pivot here could clear the way towards the key 1,722–1,700 zone, marked by the 23.6% Fibonacci and the 50-day SMA. Note that the key descending constraining line drawn from the 2,079 record high is positioned in the same area.

In the event of the bulls extending the recovery above the 200-day SMA, the 50% Fibonacci of 1,842 could be the next destination. Breaching that wall, the rally may speed up towards June’s resistance of 1,878, while higher, the focus will turn to the 61.8% Fibonacci of 1,925.

All in all, gold traders are currently displaying some hesitancy as the price is struggling to overcome the August bar of 1,800. A successful move above that barricade could bolster buying appetite.