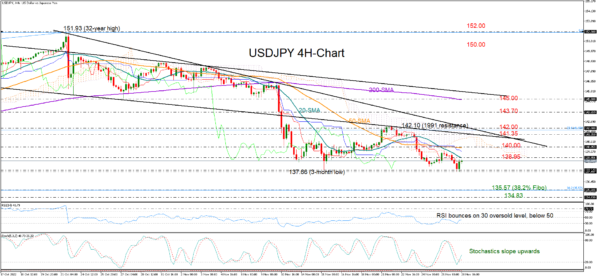

USDJPY paused its latest decline near November’s low of 137.66 before climbing back into the 138.00 territory on Monday.

The RSI and the stochastics on the four-hour chart are flagging oversold conditions, justifying the latest bullish correction in the price. However, the way higher could be rocky, as several obstacles remain intact.

The 20-period simple moving average (SMA) could postpone an extension to the 50-period SMA at 140.00. Above the latter, the pair may get congested within the 141.35–142.00 territory formed by two key constraining lines. If the bulls dominate, the next challenge could commence around 143.70, a break of which is required to drive the price up to the 200-period SMA at 145.00.

On the downside, a decisive close below the 137.66 trough may intensify selling pressures towards the 38.2% Fibonacci retracement of the September 2021– October 2022 uptrend at 135.57. Crossing below that base, the bears may take some rest around the 161.8% Fibonacci extension of the latest upleg at 134.83 before heading for the 134.00 number.

In brief, although downside pressures in USDJPY seem to be fading, the pair may remain vulnerable to bearish corrections unless it successfully crawls above 142.00.