Key Highlights

- USD/JPY started a fresh decline from the 142.25 resistance.

- It traded below a key bullish trend line with support near 141.00 on the 4-hours chart.

- Gold price is eyeing a fresh increase towards the $1,785 resistance.

- Bitcoin price might resume its decline below the $16,000 support.

USD/JPY Technical Analysis

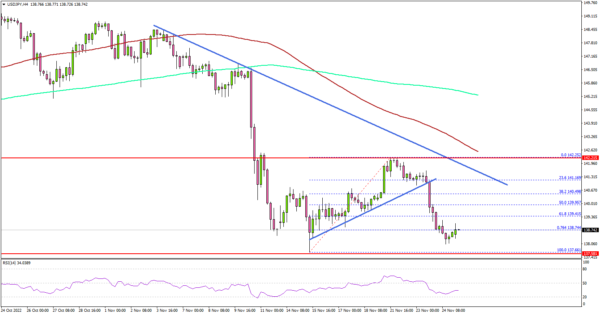

The US Dollar attempted a fresh increase above the 140.00 level against the Japanese Yen. However, USD/JPY failed to clear the 142.25 zone and started another decline.

Looking at the 4-hours chart, the pair declined below the 141.50 support level. It even settled below the 140.00 support, the 100 simple moving average (red, 4-hours) plus the 200 simple moving average (green, 4-hours).

During the decline, the pair traded below a key bullish trend line with support near 141.00 on the same chart. There was a clear move below the 61.8% Fib retracement level of the upward move from the 137.66 swing low to 142.25 high.

An initial support is near the 137.65 level. The next major support is near the 136.80 zone, below which the pair might accelerate lower.

In the stated case, USD/JPY may perhaps test the 135.00 support. Any more losses might send the pair towards the 132.00 support. On the upside, an immediate resistance is near 139.40 level.

The next major resistance may perhaps be near 140.50 and a connecting bearish trend line on the same chart. Any more gains could set the pace for a move towards the 142.25 resistance zone.

Looking at gold price, there was a strong buying interest near the $1,720 zone and the price might start a move towards the $1,785 resistance.

Economic Releases

- German Gross Domestic Product for Q3 2022 (YoY) – Forecast 1.2%, versus 1.2% previous.

- German Gross Domestic Product for Q3 2022 (QoQ) – Forecast 0.3%, versus 0.3% previous.