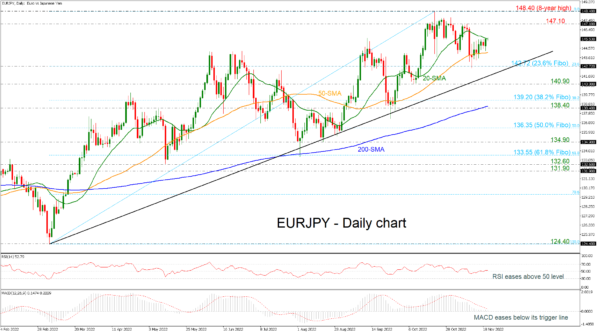

EURJPY is meeting the 20-day simple moving average (SMA) after several days of hovering within the short-term SMAs. In the broader outlook, the market is still moving above the long-term ascending trend line, endorsing the bullish picture.

However, the technical oscillators are showing some weakening bias. The flat move in the RSI and the slightly growing MACD are confirming the current neutral-to-bullish momentum in the price, though with the former nearing the neutral threshold of 50 and the MACD moving beneath its trigger line, the bears could be around the corner.

A decisive close above the 20-day SMA at 145.55 could reduce negative risks, producing another bullish extension towards the key 147.10 resistance. Beyond that, traders will target the eight-month high of 148.40, a break of which would re-activate March’s uptrend, shifting the near-term outlook from neutral to positive, though any steps higher could be limited if a new barrier pops up near the 150.00 psychological mark.

Otherwise, if sellers take the lead, the pair may pull back to test the nearby support of the 50-day SMA at 144.20 ahead of the 23.6% Fibonacci retracement level of the up leg from 124.40 to 148.80 at 142.72, which overlaps with the ascending trend line. A penetration of this line may attempt to add some footing around the 140.90 barrier, switching the long-term outlook to neutral. Falling lower, the 38.2% Fibonacci retracement at 139.20 and the 200-day SMA at 138.40 could block the negative wave.

In brief, EURJPY still needs some boost to strengthen its bullish trend in the long-term view as it is currently testing the crucial 20-day SMA.