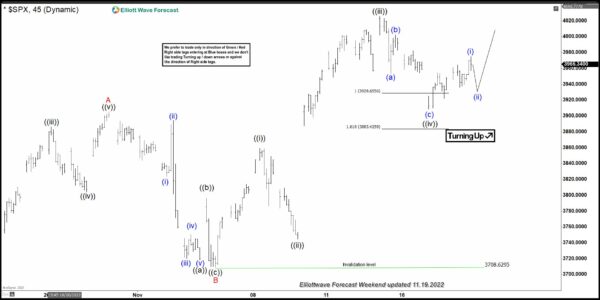

Hello fellow traders. In this article we’re going to take a quick look at the Elliott Wave charts of SPX ( S&P500) , published in members area of the website. As our members know SPX is showing higher high sequences in the short term cycle from the October 13th low. The index is looking for another push up toward 4080.4+ area ideally. Recovery looks incomplete and we expect to see more short term strength. Recently SPX made a short term pull back that has reached its target area and found buyers as expected. In the further text we are going to explain the Elliott Wave Forecast.

SPX Elliott Wave 1 Hour Chart 11.17.2022

SPX is proposed to be doing Elliott Wave Zig Zag pattern within the cycle from the October 13th Low. Structure is still incomplete. SPX has not reached extremes from the 10.13. low. Besides that , we got only 3 waves up in the cycle from the 3709.8 low which suggests another wave up is still missing. So, current view suggests wave C red is still in progress when we are now in ((iv)) of C. Once current short term pull back completes we expect to see another push up toward 4080.4 area .We expect to see more downside in near term toward 3928.6-3883.4 area. Buyers should ideally appear at the marked zone for the further rally toward new high ideally or for a 3 waves bounce at least.

SPX Elliott Wave 1 Hour Chart 11.19.2022

Pull back reached our target zone at 3928.6-3883.4 ( buyers area). SPX found buyers at that zone and we are getting reaction from there. Rally made enough separation from the lows. As a result, any longs from there should be risk free already and partial profit taken. Wave ((iv)) can be done at 3907 low and we should be ideally trading within wave ((v)) toward 4080.4 area. Alternatively if 3907 low gets broken then we can see 7 swings in wave ((iv)) .