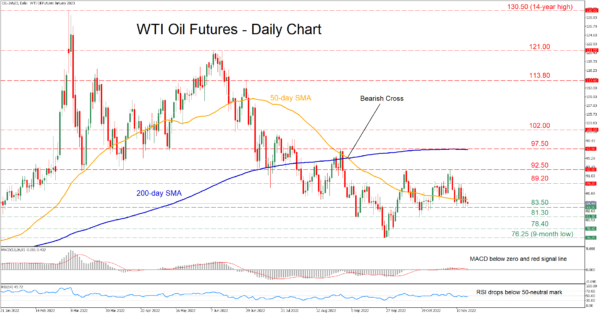

WTI oil futures (January delivery) have been stuck in a downtrend since mid-June when the price failed to surpass the 121.00 mark. Although the commodity managed to regain some ground after bouncing at the nine-month low of 76.25, the price has dropped again below its 50-day simple moving average (SMA).

The momentum indicators currently suggest that bearish forces are strengthening. Specifically, the RSI has dived beneath the 50-neutral mark, while the MACD histogram is retreating below both zero and its red signal line.

If selling pressures persist, the recent support of 83.50 could act as the first line of defense. Should that floor collapse, the bears could then aim for 81.30 before the spotlight turns to 78.40. A violation of the latter may trigger a retreat towards the nine-month low of 76.25.

On the flipside, if buyers regain control, oil futures might ascend towards the recent resistance of 89.20. Piercing through this region, the November high of 92.50 could come under examination. Conquering this barricade, further advances could then stall at the 97.50 region, which overlaps with the 200-day SMA.

Overall, WTI oil futures appear to be losing ground as negative momentum intensifies. For that bearish sentiment to alter, the price needs to initially cross above the 50-day SMA.