The dollar index edges higher in Asian / early European trading on Monday, after the greenback lost ground and fell over 4% last week, on growing expectations that cooler inflation would prompt Fed to ease its aggressive stance in policy tightening.

Comments from one of Fed’s policymakers over the weekend that the central bank was not softening its fight against inflation and that slightly lower inflation in past two months was insufficient to trigger stronger reaction from the Fed, but more easing is required to signal that inflation have peaked.

The dollar’s latest drop may continue to boost inflation by offsetting the effect of recent strong rate hikes, while inflation has registered only a marginal easing, implying that interest rates may have to remain elevated for extended period to bring inflation under control and that terminal interest rate would be higher than initially estimated.

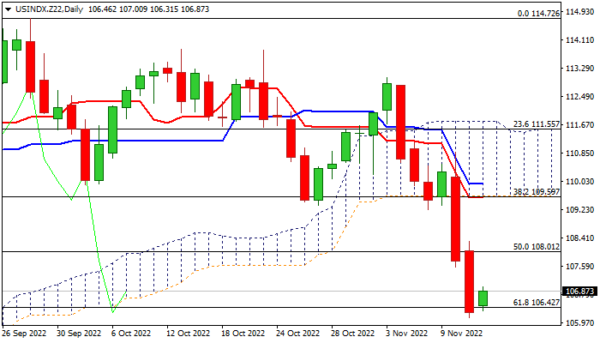

Today’s bounce could be seen as reaction on oversold daily studies and a profit-taking after a massive fall last week, but overall near-term structure is expected to remain bearish while corrective action stays below the base of thick daily cloud (109.58), reinforced by daily Tenkan-sen and 50% retracement of 113.02/106.12 bear-leg.

Such scenario would offer better selling opportunities for further drop of dollar and extension through cracked Fibo 61.8% of 104.46/114.72 (106.42) towards 104.46 (Fibo 76.4%).

Conversely, penetration of daily cloud and further rise, would signal that bears gave up and the greenback regained traction after deeper correction, but scenario would require confirmation on rise above cloud top (111.76).

Res: 107.57; 108.01; 108.30; 109.22.

Sup: 106.42; 106.12; 105.42; 104.46.