The Euro extend a steep fall from 1.0090 zone double top, falling around 0.8% on Thursday, in extension of post-Fed acceleration.

The sentiment soured further after the US central bank delivered the fourth straight 75 basis points rate hike and kept hawkish tone, although chief Powell signaled further hikes may come in smaller increments, he also signaled that the ultimate level of the benchmark policy rate would be likely higher than previously estimated, as policymakers remain firmly on track to bring red-hot inflation under control.

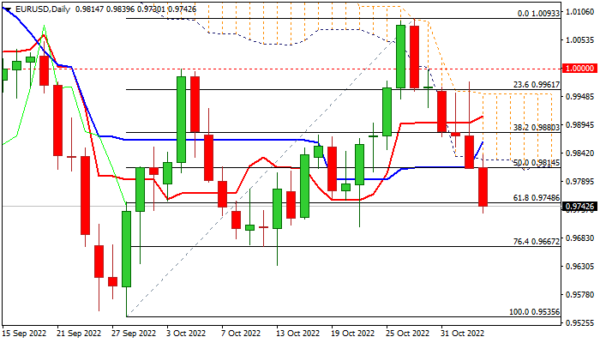

Pullback from 1.0090 zone tops extends into sixth straight day and broke through pivotal supports at 0.9768/48 (trendline support / Fibo 61.8% of 0.9535/1.0093), adding to signals that recovery phase off 0.9535 (Sep 28 low) might be over.

Bears need a daily close below these levels for confirmation, with further weakness to focus next key supports at 0.9667/0.9631 (Fibo 76.4% / Oct 13 trough).

Daily studies turned bearish as MA’s are in negative setup and falling 14-d momentum is attempting to break into negative territory that supports the action, although deeply oversold stochastic may produce headwinds.

The base of thick daily cloud (0.9829) reverted to solid resistance, which should cap upticks and keep bears intact.

Res: 0.9769; 0.9814; 0.9829; 0.9880.

Sup: 0.9730; 0.9704; 0.9667; 0.9631.