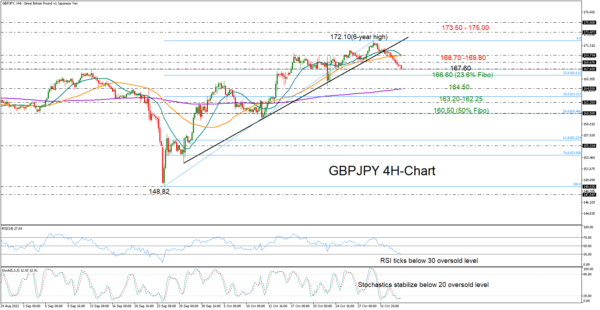

GBPJPY returned to losses after marking its largest monthly gain in more than five years in October, with the price pulling below the almost six-year high of 172.10 to trade within the 167.00 region.

The bearish wave saw another extension following the close below the ascending trendline, but the oversold signals in the RSI and the stochastics suggest that the decline in the four-hour chart might be overdone.

The key support region around 167.60 is currently under examination, while slightly beneath that, the 23.6% Fibonacci retracement of the 148.82-172.10 upleg at 166.60 could be another point to consider before the 200-period simple moving average (SMA) at 164.50 comes on the radar. If the 163.20-162.25 zone proves fragile too, the next stop could be around the 50% Fibonacci of 160.50.

Rotating upwards, the price may initially get congested somewhere between 168.70 and 169.80, where the 20- and 50-period SMAs are located as well. A decisive close above that bar could see a direct flight up to the 172.10 top and the broken ascending trendline. Even higher, the bullish trend could pause within the 173.45-175.00 area taken from 2016.

In brief, GBPJPY is holding a bearish short-term bias, though with the price trading within oversold waters, some stabilization cannot be ruled out in the coming sessions.