Key Highlights

- Crude oil price started a fresh increase above the $86.50 and $87.20 resistance levels.

- A major bullish trend line is forming with support near $85.60 on the 4-hours chart.

- Gold price might gain pace if it clears the $1,660 resistance zone.

- Today, the Fed could increase interest rates from 3.25% to 4.0%.

Crude Oil Price Technical Analysis

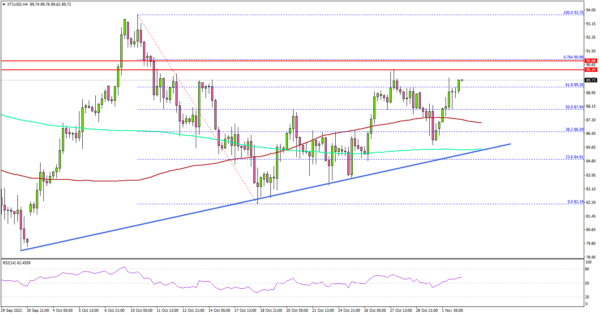

Crude oil price started a fresh increase from the $82.20 zone against the US Dollar. The price gained pace for a move above the $85.00 resistance level.

Looking at the 4-hours chart of XTI/USD, there was a break above the $86.50 resistance zone. The price even settled above the $87.20 level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

The bulls pushed the price above the 61.8% Fib retracement level of the downward move from the $93.70 swing high to $82.19 low.

On the upside, the price might face sellers near the $90.40 zone. The next major resistance is near $91.00, above which the price could accelerate higher towards the $95.00 zone.

If not, there might be a fresh decline below the $87.50 support zone. On the downside, there is a key support forming near the $85.00 zone. There is also a major bullish trend line forming with support near $85.60 on the same chart.

The next major support is near $84.00 zone. Any more losses might call for a test of the $82.20 support zone in the coming days.

Looking at gold price, there was a recovery wave above the $1,640 level, but it must clear $1,660 to set the pace for a steady increase.

Economic Releases to Watch Today

- Germany’s Manufacturing PMI for Oct 2022 – Forecast 45.7, versus 45.7 previous.

- Euro Zone Manufacturing PMI for Oct 2022 – Forecast 46.6, versus 46.6 previous.

- US ADP Employment Change for Oct 2022 – Forecast 193K, versus 208K previous.

- Fed Interest Rate Decision – Forecast 4.0%, versus 3.25% previous.