The dollar extends rally into third straight day Monday, advancing around 0.4% in Asia / early Europe on Monday.

The greenback received fresh support from renewed hopes that the Fed will remain on aggressive mode on November policy meeting and go for another 0.75% hike, after dissonant tones about reducing pace of rate hikes, faded.

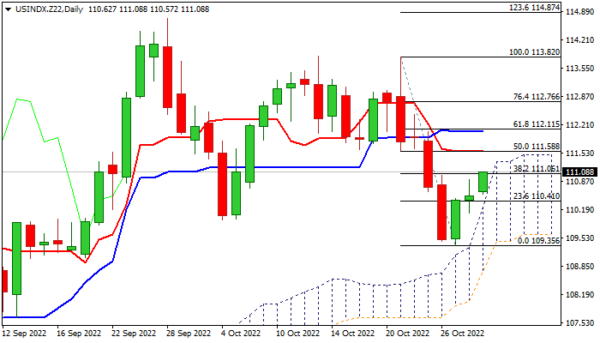

Recovery action from 109.45/35 double-bottom (Oct 26/27 lows) is underpinned by rising and thickening daily cloud and so far reached Fibo 38.2% retracement of 113.82/109.35 bear-leg), though fresh bulls need more evidence to generate bullish signal and open way for stronger recovery.

Momentum indicator is still deeply in the negative territory on daily chart and daily Tenkan-sen / Kijun-sen remain in bearish configuration that weighs on recovery, which needs lift and close above 112.00 zone (Fibo 61.8% retracement of 113.82/109.35 / daily Kijun-sen) to strengthen near-term structure and confirm base at 109.35/45.

Near-term action needs to hold above broken 55DMA (110.50) to keep fresh bulls in play.

Res: 111.33; 111.58; 112.11; 112.44.

Sup: 110.50; 110.00; 109.60; 109.35.