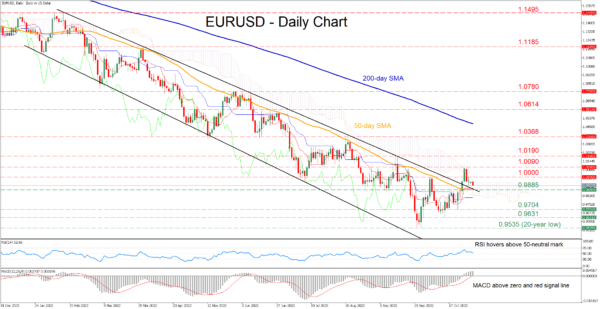

EURUSD has been losing ground since the beginning of the year, creating a clear structure of lower highs and lower lows. Although the pair managed to cross above both its descending channel and the 50-day simple moving average (SMA), it quickly retraced lower slightly below parity.

The momentum indicators currently suggest that bullish forces are subsiding but still hold the upper hand. Specifically, the RSI is pointing downwards above its 50-neutral mark, while the MACD histogram is softening above both zero and its red signal line.

Should buying pressures intensify, initial resistance could be encountered at parity, which is considered a crucial psychological mark by markets. Jumping above the latter, the price could challenge the recent rejection point of 1.0090 before the spotlight turns to the September peak of 1.0190.

To the downside, bearish actions could meet immediate support at the 0.9885 congested region, which includes the 50-day SMA and the restrictive trendline taken from the pair’s recent highs. Sliding beneath that floor, the pair could descend towards 0.9704 before it challenges the October low of 0.9631. A violation of the latter could open the door for the 20-year low of 0.9535.

Overall, despite its recent upside breakout, EURUSD appears to be losing momentum. Hence, for the pair to resume its recovery, the descending trendline must curb any potential declines.