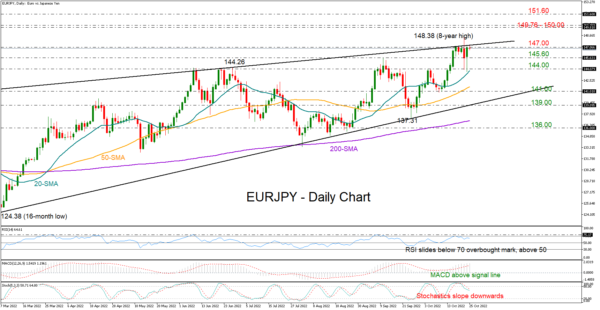

EURJPY quickly recovered Friday’s sharp pullback, but it could not close above the tough 147.00 ceiling, which has been restraining bullish movements for almost a week now. Strikingly, the resistance line drawn from August 2020 is also positioned in the same area.

The RSI and the stochastics have fallen from overbought levels, reflecting a weakening bias. Yet, the former is still comfortably above its 50 neutral mark, while the MACD is well elevated above its red signal line, both suggesting that buyers have not abandoned the market yet.

On the downside, a close below September’s high of 145.62 could bring the 20-day simple moving average (SMA) under the spotlight around 144.00. Even lower, the price may seek shelter near its previous low of 140.89, a break of which could press the price straight to the March support line currently around 139.00.

In case the price advances above the 147.00 mark, the rally could stabilize near the 2014 top of 149.76 and the 150.00 psychological mark. The next obstacle could emerge around the 151.60 level last active during 2007-2008.

In brief, EURJPY is looking cautiously bullish as the price is consolidating its gains near a key resistance territory. Overall, the upward pattern is still intact and only a decisive decline below 144.00 would violate it.