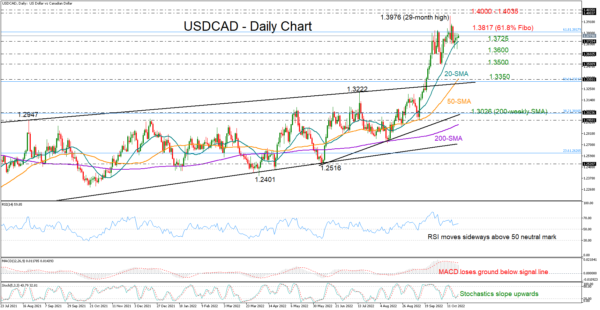

USDCAD has partially recovered Monday’s pullback as the 1.3800 level proved hard to overcome during the week, limiting bullish moves.

Although the RSI and the MACD reflect some caution as the former is lacking direction in the bullish area, and the latter keeps decelerating below its red signal line, the positive trend is still intact above the 20-day simple moving average (SMA).

If the bulls manage to pierce through the 1.3800 level, where the 61.8% Fibonacci retracement of the 1.4667-1.2006 downtrend is located, the price could accelerate towards the 1.4000-1.4035 region taken from March-May 2020. Breaching that wall too, the next stop could be the 1.4140 barrier.

In the bearish scenario, where the price closes below the 20-day SMA at 1.3725, immediate support could develop around the 1.3600 level. Even lower, the 1.3500 psychological mark may attempt to block any declines towards the 50-day SMA and the 50% Fibonacci of 1.3330.

In summary, the focus is on the 1.3800 round level, a break of which is expected to reduce negative risks, triggering the next leg higher in USDCAD.