Key Highlights

- USD/CAD corrected lower from the 1.4000 resistance zone.

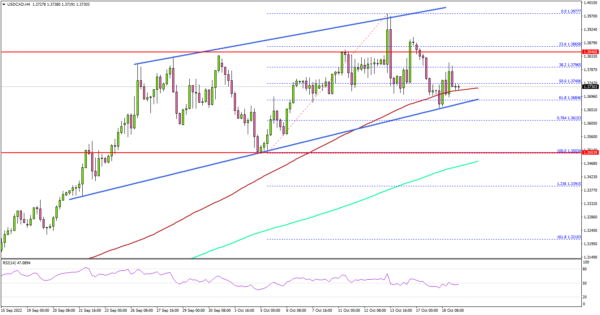

- A key rising channel is forming with support near 1.3680 on the 4-hours chart.

- Crude oil price is moving lower and might dive below $80.

- The Canadian CPI could increase 6.8% in Sep 2022 (YoY), down from 7.0%.

USD/CAD Technical Analysis

The US Dollar gained strength above the 1.3500 resistance against the Canadian Dollar. However, USD/CAD failed to continue higher above 1.4000.

Looking at the 4-hours chart, the pair formed a top near the 1.3977 level. It started a downside correction below the 1.3900 level. The pair declined below the 50% Fib retracement level of the upward move from the 1.3503 swing low to 1.3977 high.

However, the pair found support near the 1.3680 zone and the 100 simple moving average (red, 4-hours) or the 61.8% Fib retracement level of the upward move from the 1.3503 swing low to 1.3977 high.

There is also a key rising channel forming with support near 1.3680 on the same chart. If there is a downside break, the pair might decline towards the 1.3500 support or the 200 simple moving average (green, 4-hours).

On the upside, the pair is facing resistance near the 1.3800 level. The next major resistance is near the 1.3850. A clear move above the 1.3850 level might send the pair towards the 1.3920 level. The next major hurdle could be near the 1.4000 level.

Looking at crude oil price, there was a steady decline below the $85 support and the price might even decline below the $80 support.

Economic Releases

- UK Consumer Price Index for Sep 2022 (YoY) – Forecast +10%, versus +9.9% previous.

- UK Core Consumer Price Index for Sep 2022 (YoY) – Forecast +6.4%, versus +6.3% previous.

- Canadian Consumer Price Index for Sep 2022 (MoM) – Forecast 0%, versus -0.3% previous.

- Canadian Consumer Price Index for Sep 2022 (YoY) – Forecast +6.8%, versus +7.0% previous.