Key Highlights

- USD/JPY rallied further and traded to a new multi-year high above 147.00.

- A major bullish trend line is forming with support at 146.50 on the 4-hours chart.

- Gold and oil came under pressure after the US CPI report.

- The US CPI increased 8.2% in Sep 2022 (YoY), more than the forecast of 8.1%.

USD/JPY Technical Analysis

The US Dollar started a fresh increase above the 145.00 resistance against the Japanese Yen. USD/JPY traded to a new multi-year high and even cleared the 147.00 level.

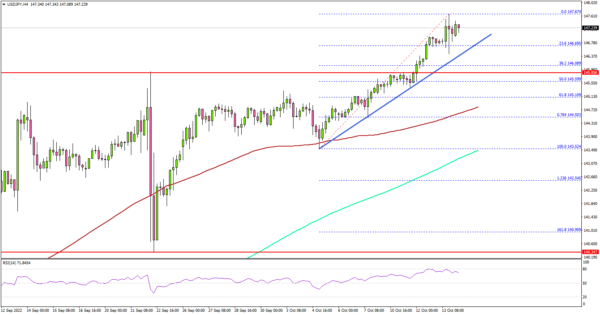

Looking at the 4-hours chart, the pair settled well above the 145.00 level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

There was a clear move above the 147.00 and 147.20 resistance levels. Besides, the pair spiked higher after the US CPI data was released. The market forecast was +8.1% in Sep 2022, compared with the same month a year ago.

However, the CPI increased 8.2% in Sep 2022, less than the last 8.3%. The pair spiked higher and cleared the 147.50 level to set a new multi-year high.

If the bulls remain in action, the pair may perhaps rise above the 148.00 level. The next major resistance is near the 148.50 level. A clear move above the 148.50 level might send the pair towards the 150.00 level. The next major hurdle could be near the 152.00 level.

On the downside, an initial support is near the 146.20 level. The main support sits at the 145.50 level. There is also a major bullish trend line forming with support at 146.50 on the same chart. A downside break below the 145.50 zone might send the pair towards the 144.20 level.

Looking at gold price, there was a sharp bearish reaction after the US CPI data and the price declined below the $1,650 support zone, but later recovered.

Economic Releases

- US Import Price Index for Sep 2022 (MoM) – Forecast -1.1%, versus -1.0% previous.

- US Export Price Index for Sep 2022 (MoM) – Forecast -1.0%, versus -1.6% previous.

- US Retail Sales for Sep 2022 (MoM) – Forecast +0.2%, versus +0.3% previous.