The Euro edges higher in European trading on Friday, consolidating a sharp fall on Wed/Thu (2.04%).

Renewed risk aversion which dragged the euro lower, is likely to gain pace as markets expect a robust US jobs report that would give a fresh signal to the US central bank for further aggressive tightening.

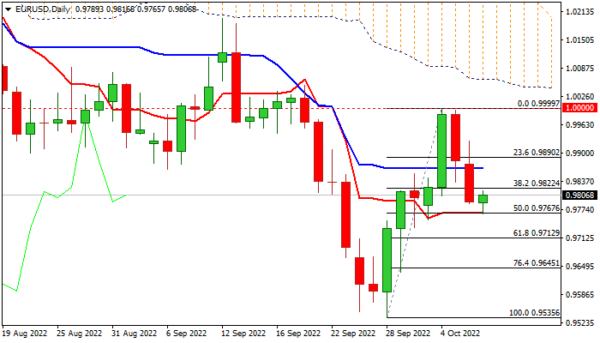

Bearish signals on daily chart from a double-top at parity level and a bull-trap above 0.9949 (Fibo 61.8% of 1.0197/0.9535) weigh on Euro along with weak daily studies, in addition to continuing pressure from a gap between the Fed/ECB interest rates.

Upticks should be ideally capped by broken Fibo 38.2% (0.9822), though near-term action is expected to remain biased lower while holding below daily Kijun-sen (0.9866).

Bearish continuation through temporary footstep at 0.9767 (50% of 0.9935/0.9999 / daily Tenkan-sen) would expose targets at 0.9712 (Fibo 61.8% of 0.9935/0.9999 and 0.9645 (Fibo 76.4%) with stronger bearish acceleration on positive NFP surprise to risk retest of 20-year low at 0.9535.

Res: 0.9822; 0.9866; 0.9890; 0.9926

Sup: 0.9767; 0.9712; 0.9645; 0.9585