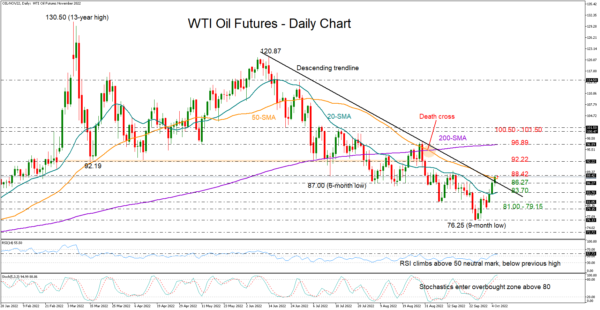

WTI oil futures (November delivery) are heading for their largest weekly gain since May, with the price stretching its bounce off the nine-month low of 76.25 up to 88.42 on Wednesday.

The market managed to close marginally above the 50-day simple moving average (SMA) too, as it did in late August when the price immediately changed direction to the downside. A repetition of that incident is possible since the RSI has yet to overcome its previous high above its 50 neutral mark, while the stochastics are already hovering within the overbought territory.

In trend signals, despite the clear negative trajectory in the short-term picture, the death cross between the 50- and 200-day SMAs is also playing down any hope for a bullish trend reversal. Yet, in the weekly chart, traders will wait and see whether the market can confirm last week’s bullish spinning top candlestick with strong gains. If this happens, there will be a higher chance for a positive change in the market direction.

If the recovery continues above 88.42, the next obstacle could pop up around 92.20. Beyond that, the 200-day SMA currently at 96.89 may block the way towards the 100.50-101.50 restrictive zone.

In the event selling pressures resurface, pressing the price below the descending trendline at 86.27, the spotlight will fall on the 20-day SMA at 83.70. Moving lower, the bears may take a breather within the 81.00-79.15 region before battling the 76.25 low again. Snapping that floor, the downtrend could chart a new trough around 72.70, which was last seen in December 2021.

Summarizing, WTI oil futures keep facing downside risks despite their latest progress. A sustainable move above 88.42 could bring new buyers into the market.