Key Highlights

- USD/JPY is showing bullish signs above the 144.00 support.

- It is facing a major resistance near 145.00 and 145.40 on the 4-hours chart.

- Gold and oil are facing important hurdles near $1,665 and $85 respectively.

- The UK GDP could contract 0.1% in Q2 2022 (QoQ).

USD/JPY Technical Analysis

The US Dollar remained strong above 140.00 against the Japanese Yen. USD/JPY started a fresh increase and broke a major hurdle at 142.50.

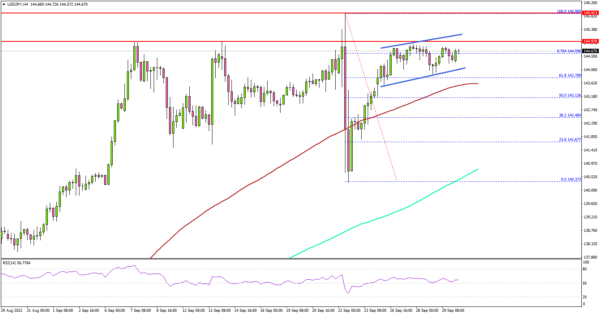

Looking at the 4-hours chart, the pair gained pace for a move above the 143.00 level and the 100 simple moving average (red, 4-hours). The pair climbed above the 50% Fib retracement level of the downward move from the 145.90 swing high to 140.37 low.

The pair settled above the 140.00 level and is trading well above the 200 simple moving average (green, 4-hours). The pair consolidated near the 76.4% Fib retracement level of the downward move from the 145.90 swing high to 140.37 low.

On the upside, an initial resistance sits near the 145.00 zone. The first major resistance is near the 145.40. The main resistance sits near the 145.90 level.

A clear move above the 145.90 level could send the pair towards 146.50. Any more gains might send the pair towards the 148.00 resistance level. On the downside, an initial support is near the 144.00 level.

The main support sits at the 143.60 level and the 100 simple moving average (red, 4-hours). A downside break below the 143.60 zone might send the pair towards the 142.50 level. The next major support is near the 141.20 level, below which the pair could even test the 140.00 support zone.

Looking at oil price, there is a key hurdle forming near $84.40 and $85.00. If there is no upside break, the price could decline towards $75.00.

Economic Releases

- UK GDP for Q2 2022 (QoQ) – Forecast -0.1%, versus -0.1% previous.

- Germany’s Unemployment Rate for Sep 2022 – Forecast 5.5%, versus 5.5% previous.

- Euro Zone Unemployment Rate for August 2022 – Forecast 6.6%, versus 6.6% previous.

- US Personal Income for August 2022 (MoM) – Forecast +0.3%, versus +0.2% previous.