Key Highlights

- GBP/USD traded to a new low at 1.0340 before it corrected higher.

- A major bearish trend line is forming with resistance near 1.1050 on the 4-hours chart.

- EUR/USD corrected higher, but it is facing many hurdles.

- AUD/USD and NZD/USD at risk of more downsides.

GBP/USD Technical Analysis

The British Pound started a major decline from well above 1.1000 against the US Dollar. GBP/USD tumbled over 500 pips to set a new low.

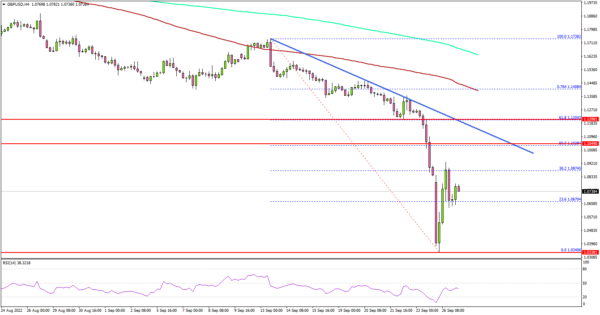

Looking at the 4-hours chart, the pair traded below the 1.0650 support level to move further into a bearish zone. The pair settled well below the 1.1000, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

A new low was formed near 1.0340 before the pair started an upside correction. There was a minor increase above the 1.0650 level.

The pair climbed above the 23.6% Fib retracement level of the downward move from the 1.1738 swing high to 1.0340 low. On the upside, an initial resistance sits near the 1.0950 zone.

The first major resistance is near the 1.1000. There is also a major bearish trend line forming with resistance near 1.1050 on the same chart. The trend line is near the 50% Fib retracement level of the downward move from the 1.1738 swing high to 1.0340 low.

A clear move above the trend line resistance could open the doors for a fresh increase to 1.1200. Any more gains might send the pair towards the 1.1400 resistance level.

On the downside, an initial support is near the 1.0650 level. The main support sits at the 1.0550 level. A downside break below the 1.0550 zone might send the pair towards the 1.0500 level. The next major support is near the 1.0340 level, below which the pair could even test the 1.0200 level.

Looking at EUR/USD, the pair started a short-term upside correction from the 0.9550 low, but it is facing many hurdles on the upside near 0.9750 and 0.9850.

Economic Releases

- US New Home Sales for Aug 2022 (MoM) – Forecast -4.9% versus -12.6% previous.

- US Durable Goods Orders for Aug 2022 – Forecast -1.1% versus -0.1% previous.