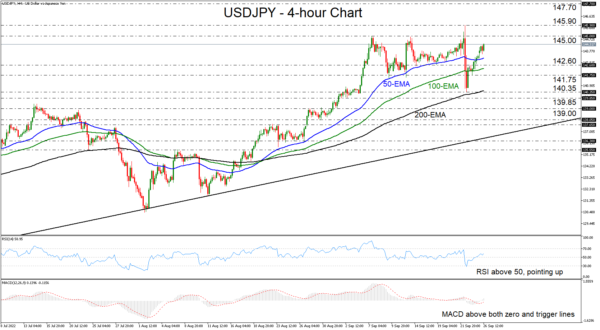

USDJPY has been in a recovery mode since Thursday, just hours after it tumbled more than 500 pips due to the BoJ’s intervention. The pair triggered some buy orders near 140.35, and it has since then recovered more of the intervention-related losses. In the bigger picture, the pair remains above the upside support line drawn from the low of March 4, which implies that the prevailing uptrend remains intact.

Both the short-term oscillators detect upside momentum, supporting the notion that the recovery will continue, at least for a while more. The RSI is lying above 50 and is pointing up, while the MACD is running above both its zero and trigger lines, pointing north as well.

The bulls may soon once again challenge the 145.00 hurdle, but the big test may come if and when they manage to overcome it. The last time they did, the BoJ decided to step in and tried to support its currency. However, if nothing similar happens this time around and the bulls manage to climb above Thursday’s peak of 145.90, then they may get encouraged to stay in the game until they get to the 147.70 zone, marked as a resistance by the peak of August 11, 1998.

The move that could trigger another decent correction may be a dip below 141.75, which was proven as a decent support before the intervention episode and just the day after. Such a break may initially allow declines towards Thursday’s low of 140.35 or the low of September 2, at 139.85. If the bears do not stop there, they may then extend their march towards the 139.00 territory, marked by the inside swing highs of August 29, 30 and 31.

To sum up, USDJPY has already recovered a large portion of its intervention-related losses, and with the prevailing uptrend staying intact, there is a decent chance for further advances and perhaps another break above the 145.00 territory.