Key Highlights

- EUR/USD declined heavily below the 0.9900 support zone.

- It broke a major bullish trend line at 0.9970 on the 4-hours chart.

- GBP/USD also declined sharply below the 1.1000 support zone.

- Gold and crude oil price traded to a new monthly low.

EUR/USD Technical Analysis

The Euro failed to remain stable above the parity level against the US Dollar. EUR/USD started a strong decline and traded below many important support levels to set a new 20-year low.

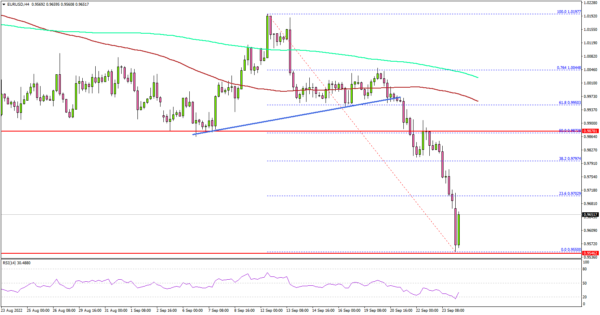

Looking at the 4-hours chart, the pair traded below the 0.9980 support level and a major bullish trend line. It opened the doors for a sharp move below the 0.9900 support zone.

The pair settled below the 0.9900 level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours). The decline gained pace below the 0.9800 support zone and the pair even traded below 0.9700.

There was a more than 250 pips decline and the pair traded to a new 20-year low at 0.9550. It is now correcting losses and trading above the 0.9600 level. On the upside, an initial resistance sits near the 0.9700 zone.

The first major resistance is near the 0.9750. A clear move above the 0.9750 level could open the doors for a fresh increase to 0.9800. Any more gains might send the pair towards the 0.9880 resistance level.

On the downside, an initial support is near the 0.9600 level. The main support sits at the 0.9550 level. A downside break below the 0.9550 zone might send the pair towards the 0.9500 level. The next major support is near the 0.9320 level, below which the pair could even test the 0.9250 level.

Looking at gold price, the price extended its decline and traded below the $1,660 support zone. Similarly, crude oil price declined below the $80 support.

Economic Releases

- German IFO Business Climate Index for Sep 2022 – Forecast 87.1, versus 88.5 previous.

- German IFO Current Assessment Index for Sep 2022 – Forecast 96.0, versus 97.5 previous.