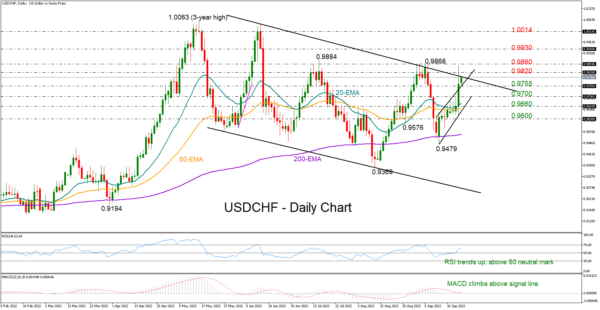

USDCHF experienced its most volatile daily session since June 2021 on Thursday, fluctuating vigorously between a low of 0.9619 and a high of 0.9849.

The pair managed to distance significantly above its exponential moving averages (EMAs), but the bullish fuel was not enough to exit the bearish-to-neutral trajectory in the medium-term picture, with the price closing below July’s high of 0.9668.

Nevertheless, with the RSI jumping decisively above its 50 neutral level and the MACD climbing back above its red signal line, there are hopes for further improvement in the market.

Encouragingly, the broken short-term resistance line drawn from mid-September is currently buffering downside pressures, adding to optimism that the pair may gain fresh impetus above the 0.9800 number and towards the key 0.9860 region. A clear step above the latter could lift the price up to 0.9930, while higher, all attention will turn to the crucial 1.0014 barricade.

In the event the pair pulls below the support trendline at 0.9755, the downfall could initially take a breather around the 0.9700 psychological mark before stretching towards the ascending trendline at 0.9660, where the 20- and 50-day EMAs also reside. Should the sell-off sharpen here, the next stop could be near the 0.9600 number.

All in all, Thursday’s steep ascent in USDCHF has pushed the bias into the bullish area, but left the outlook fragile. To change that, the pair will need to run firmly above the 0.9820- 0.9860 zone.