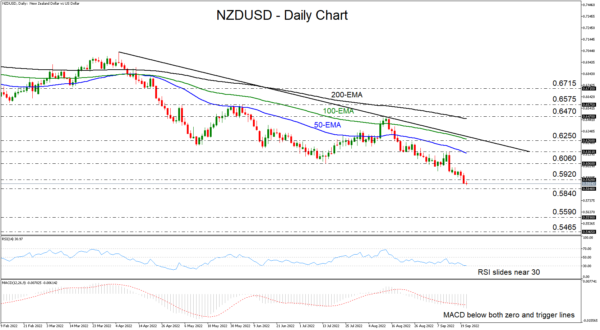

NZDUSD slipped below 0.5920 yesterday, a level marked as a support by the low of May 15, 2020. Overall, the pair continues to trade below a tentative downside resistance line drawn from the high of April 5, as well as below all the plotted moving averages. Therefore, the support breach in the direction of the prevailing trend implies that more declines may be in the works for the foreseeable future.

The RSI and the MACD add credence to the narrative, with the former sliding and touching its 30 line, and the latter running below both its zero and trigger lines. Both are detecting strong downside speed.

With the bears in the driver’s seat, the next level to be challenged may be at 0.5840, marked by the low of April 3, 2020. A break lower could darken the picture even more and perhaps pave the way towards the low of March 23, 2020. If the bears are not willing to surrender there either, then they could dive towards the low of March 19 of that year, at around 0.5465.

The bulls could start feeling confident upon a break above 0.6250 as such a move may verify the break above the aforementioned downside line. If indeed this happens, they may climb towards the 200-exponential moving average or the 0.6470 obstacle, marked by the high of August 12. Slightly higher lies another resistance at 0.6575, the break of which may extend the advance towards the 0.6715 area, defined by the inside swing lows of April 18, 19, and 20.

Recapitulating, NZDUSD extended its bearish trend yesterday, by breaking below the support of 0.5920. With all the technical signs and indicators pointing to a downtrend, it seems that lower levels could be met very soon.