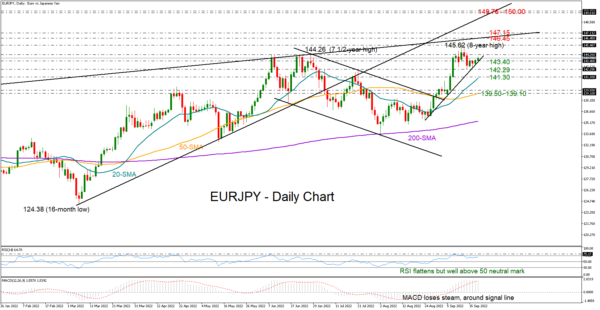

EURJPY stepped on the short-term ascending trendline, as it halted last week’s pullback from the new eight-year high of 145.62.

With the price trading comfortably above its upward-sloping simple moving averages (SMAs) and the momentum indicators hovering within the bullish territory despite their flat trajectory, upside moves are more likely than downside ones. Specifically, the RSI is a long distance above its 50 neutral mark, while the MACD is well elevated within the positive zone and near its red signal line.

A durable move above June’s tough ceiling of 144.26 could be the key for an acceleration towards the important long-term resistance line that joins all the highs from August 2020, currently seen around 146.45. A break above the 147.15 barrier could then pave the way towards the 2014 top of 149.76 and the 150 psychological mark, where the ascending line drawn from March lows is positioned.

In the bearish scenario, a cross below the support trendline at 143.40 could confirm an extension towards the 142.29 handle, while lower, the price could meet the 20-day SMA around 141.30. Failure to bounce from there may enhance selling interest towards the 139.50 – 139.10 region.

All in all, EURJPY may push for higher highs in the short term, with traders waiting for a clear confirmation signal above 144.26 to boost buying exposures.