The USDJPY stands at the front foot on Monday, though still within a narrow consolidation under new 24-year high, which extends into third consecutive day.

Last week’s bullish close market the fifth straight weekly advance, as the dollar remains robust on expectations for another large rate hike by Fed and safe haven flows on growing uncertainty on looming recession.

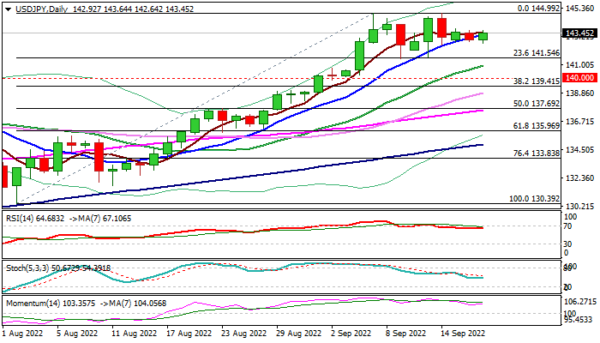

Bullish technical studies underpin the action for a final push through key 145 barrier, where the action recently failed twice, keeping the pair in extended consolidation, but double-rejection of dips at 141.50 zone, suggesting that the downside is well protected for now.

All eyes are on central banks, as the Fed is widely expected to deliver another 0.75% hike on Wednesday, with some expectations for even more aggressive action and 1% hike that would strongly inflate the dollar.

On the other side, the Bank of Japan is expected to keep its ultra-loose policy unchanged on Thursday that would further widen the divergence between two monetary policies and add pressure on Japanese yen.

Near-term bias is expected to remain firmly bullish as the action stays above 141.50 zone, however, possible deeper dips need to stay above psychological 140 support to keep overall bullish structure intact. Eventual break of 145 pivots would risk fresh acceleration and unmask 1998 peak at 147.68.

Res: 143.80; 144.11; 144.55; 144.99.

Sup: 142.64; 142.00; 141.50; 140.94.