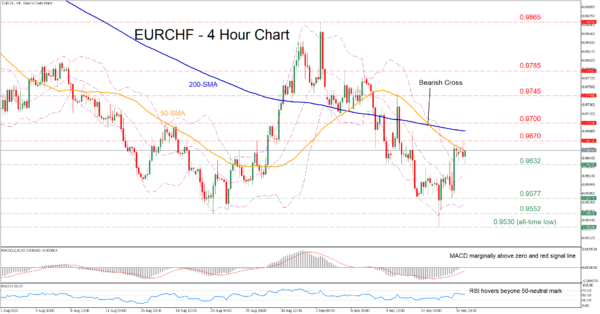

EURCHF has been gaining some ground in the short term after its sharp decline came to a halt at the all-time low of 0.9530. However, the recent price recovery has been repeatedly held down by the descending 50-period simple moving average (SMA) and the upper Bollinger band.

The momentum indicators currently suggest that bullish forces remain in control, but they are moderating. The MACD histogram is found above zero and its red signal line, while the RSI is flatlining beyond its 50-neutral mark.

Should buying pressures intensify and the price crosses above the 50-period SMA, initial resistance could be met at the recent high of 0.9670. A jump above the latter could then shift the attention to the August resistance zone of 0.9700 before the 0.9745 peak appears on the radar. Even higher, the 0.9785 hurdle might prove to be a tough one for the bulls to overcome.

On the flipside, if positive momentum wanes and the price drifts lower, 0.9632 could act as the first line of defence. Sliding beneath that floor, the bears could aim for 0.9577 before the spotlight turns to the August low of 0.9552. Failing to halt there, the all-time low of 0.9530 might come under examination.

In brief, EURCHF’s recovery appears to be in danger as the 50-period SMA has been acting as a stronghold. Therefore, a clear close above the latter could ignite buyers’ hopes for a sustained uptrend.