- Price action is expected to continue with its downtrend (red arrows) as part of a wave 3 (yellow). The main targets are the Fibonacci at 1.1325, 1.1250, and 1.1175.

- The NGAS chart offers a classical head and shoulders reversal chart pattern (orange boxes).

- The BTC break of the bottom should complete the bullish, shallow wave 4 (yellow) and start the bearish wave 5 (yellow).

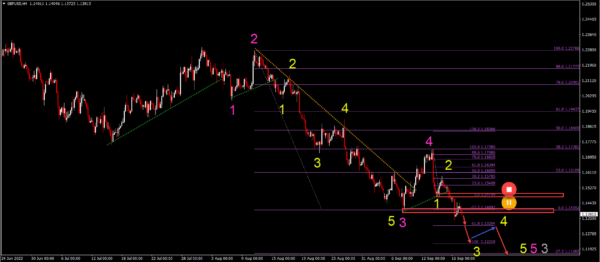

GBP/USD bears take control and break bottom

The GBP/USD made a bullish retracement to and bearish bounce at the 38.2% Fibonacci resistance level:

- The GBP/USD bounce at the 38.2% Fib indicates a wave 4 (pink) pattern.

- Price action has now broken below the bottom after a strong bearish decline, which has been labeled as a wave 1 (yellow).

- Price action is expected to continue with its downtrend (red arrows) as part of a wave 3 (yellow).

- The main targets are the Fibonacci levels at 1.1325, 1.1250, and 1.1175.

- Eventually a shallow retracement is expected to occur within wave 4 (yellow).

- The retracement should not break above the previous bottoms and resistance zones (red boxes).

- A further decline is then expected within wave 5 (yellow).

- A bullish push above the resistance levels makes it likely that another wave pattern is valid.

NGAS head and shoulders pattern indicates reversal

The NGAS 4 hour chart is showing a reversal chart pattern:

- The NGAS chart offers a classical head and shoulders reversal chart pattern (orange boxes).

- The bullish push up within wave B/2 stopped at the 61.8% Fibonacci level.

- The bearish decline after the bearish bounce has been very strong and is likely some type of wave 3 (yellow).

- A mild retracement within the wave 4 (yellow) could take price eventually back to the 23.6% or 38.2% Fibonacci levels.

- A deeper bullish retracement invalidates the wave 4 (yellow) pattern.

- A bearish continuation aims for the Fibonacci targets down below.

- If price action only reaches the -27.2% Fibonacci target, then it’s most likely a wave C ([pink). If price action goes to the -61.8% Fib, then it could be either a wave 3 or C.

- A break below the -61.8% Fibonacci level indicates a wave 3 (pink).

BTC/USD breaks low and prepares for decline

Bitcoin (BTC/USD) is breaking the bottom and low for a continuation of the downtrend:

- The BTC/USD bulls are disappointed yet again after a bullish rally was unable to break above the resistance zone.

- The break of the bottom should complete the bullish, shallow wave 4 (yellow) and start the bearish wave 5 (yellow).

- The main target is the -27.2% Fibonacci target around $12k with an important zone around the round level of $15k.

- The wave 5 (yellow) could move lower within a falling wedge reversal chart pattern (orange lines).

- A strong bullish bounce is needed to confirm the start of any reversal (blue arrows)

- The wave 5 (yellow) would complete a wave C (pink) of wave W (pink) or wave 2 (gray).