Key Highlights

- USD/JPY seems to be forming a double top near 145.00.

- It is testing a major bullish trend line at 142.85 on the 4-hours chart.

- Gold price declined heavily below the $1,680 support zone.

- GBP/USD is at a risk of more losses below the 1.1420 level.

USD/JPY Technical Analysis

The US Dollar made another attempt to clear the 145.00 resistance zone against the Japanese Yen. However, USD/JPY struggled to continue higher and corrected lower.

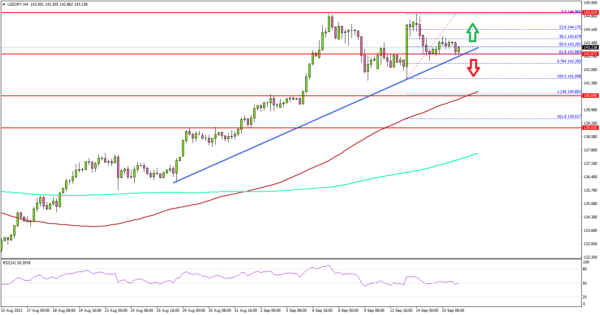

Looking at the 4-hours chart, the pair seems to be forming a double top near 145.00. The pair is slowly moving lower and there was a break below the 50% Fib retracement level of the upward move from the 141.59 swing low to 144.96 high.

It is now testing a major bullish trend line at 142.85 on the same chart. The trend line is near the 61.8% Fib retracement level of the upward move from the 141.59 swing low to 144.96 high.

A downside break below the trend line support might spark a sharp decline towards the 141.50 support. The next major support is near the 140.50 level, below which the pair could even test the 140.00 level and the 100 simple moving average (red, 4-hours).

On the upside, the pair might face resistance near the 143.80 level. The next major resistance is near the 144.20 level. The main resistance is still near the 145.00 level.

A clear move above the 145.00 resistance might start a strong increase. The next major resistance is near 146.50, above which the pair may perhaps rise towards the 148.00 level.

Looking at gold price, the bulls failed to protect the $1,680 support and there was a sharp decline towards the $1,660 support zone.

Economic Releases

- UK Retail Sales for August 2022 (YoY) – Forecast +1.7%, versus +4% previous.

- UK Retail Sales for August 2022 (MoM) – Forecast -0.8%, versus +2.3% previous.

- Michigan Consumer Sentiment Index for Sep 2022 (Prelim) – Forecast 63.0, versus 65.5 previous.