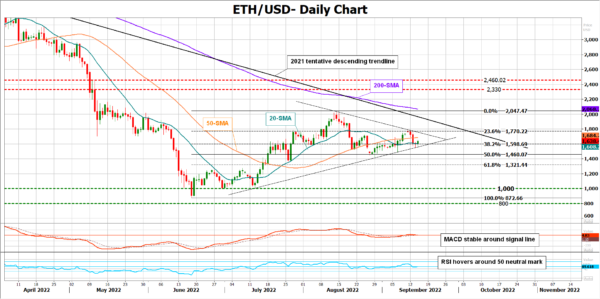

Ethereum (ETHUSD) has been in the red so far this week, gradually retreating after almost touching the 1,800 round level. Despite the soft negative mood, the short-term bias has not switched to the bearish side yet, as the second most popular crypto keeps trading within a symmetrical triangle.

The momentum indicators are also reflecting a wait-and-see attitude among traders given the sideways trajectory in the RSI and the MACD.

The 38.2% Fibonacci retracement of the latest upleg is currently canceling selling pressures around 1,600. If it gets defeated, with the price closing below the triangle, the spotlight will immediately turn to the 50% Fibonacci of 1,460, while the 61.8% Fibonacci of 1,321 could be of greater importance since any violation at this point may directly squeeze the price towards the 1,000 psychological mark. Even lower, the bears will aim for a downtrend resumption below the 800 number.

For the bulls to take the lead, the price will need to advance above the triangle and the 23.6% Fibonacci of 1,770. If that turns out to be the case, all attention will shift to the critical area of 1,975-2,047, formed by the 2021 tentative descending trendline and the 200-day simple moving average (SMA). Declaring another victory here, the bulls could pick up steam towards the 2,330 – 2,460 resistance area.

All in all, the horizontal trajectory in Ethereum suggests some patience until a clear breakout happens above 1,770 or below 1,600.