Spot gold extends steep decline from $1735 lower top into third consecutive day, under renewed pressure from fresh strength of the dollar.

US inflation rose above expectations in August, adding to expectations that Fed will deliver another massive 75 basis points rate hike next week, giving fresh boost to the greenback, which was in defensive in past few days and deflating the yellow metal.

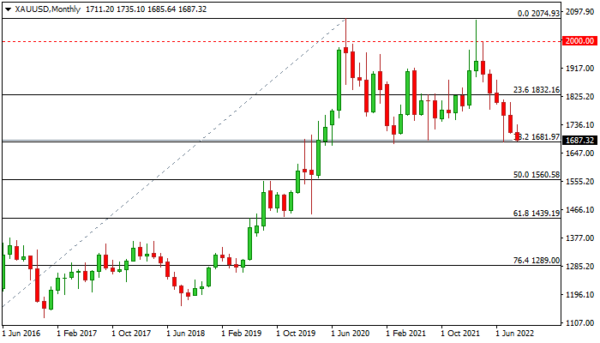

Fresh weakness hit the lowest in eight weeks in early Thursday’s trading and pressuring key supports at $1680 zone, where lows from Mar 2021 till July 2022 formed a higher base on a monthly chart, with support being reinforced by Fibo 38.2% of larger $1046/$2074 ascend (2015/2020) and 200WMA.

Technical studies are bearish on daily and weekly chart, supporting the action, though oversold conditions suggest that bears are likely to face increased headwinds on approach to key supports.

Firm break of $1680 zone would open way for stronger acceleration lower, as completion of a double-top pattern on monthly chart on break of higher base would generate reversal signal and risk extension towards $1560 zone (Apr 2020 low/50% retracement of 1046/$2074).

Broken psychological $1700 support and falling 10DMA ($1708) offers solid resistances which should cap upticks.

Res: 1691; 1700; 1708; 1721.

Sup: 1680; 1676; 1632; 1608.