Key Highlights

- Crude oil price started a steady increase above the $85 resistance.

- It broke a major bearish trend line with resistance at $87.50 on the 4-hours chart.

- Gold price is consolidating losses below the $1,720 resistance zone.

- EUR/USD could revisit the 0.9900 support zone, and GBP/USD is holding the 1.1440 support.

Crude Oil Price Technical Analysis

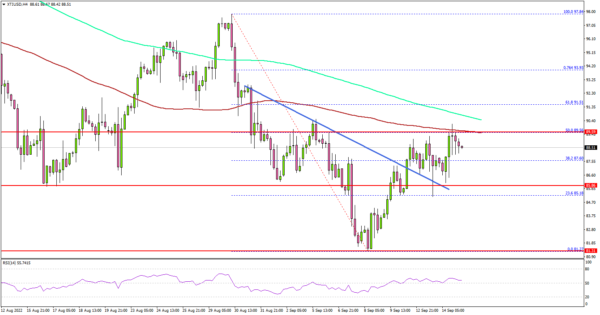

After declining towards the $81.20 zone, crude oil price found support against the US Dollar. The price started a steady increase and was able to clear the $85 resistance.

Looking at the 4-hours chart of XTI/USD, there was a break above the $86.50 resistance and a major bearish trend line with resistance at $87.50. It opened the doors for more upsides above the 38.2% Fib retracement level of the downward move from the $97.84 swing high to $81.27 low.

The bulls pushed the price to the $90 zone and the 100 simple moving average (red, 4-hours). The price also tested the 50% Fib retracement level of the downward move from the $97.84 swing high to $81.27 low.

A clear move above the $90.00 level and the 200 simple moving average (green, 4-hours) could push the price further higher.

The next major resistance is near $91.50, above which the price could accelerate higher towards the $94.50 zone.

On the downside, an initial support is near the $87.50 level. The next major support is near $85.80. The main support sits near $85, below which there is a risk of a move towards the $82.50 level. Any more losses might call for a test of the $81.20 zone.

Looking at gold price, the bulls are protecting the $1,690 zone, but the price might continue to face resistance near $1,720.

Economic Releases to Watch Today

- US Retail Sales for August 2022 (MoM) – Forecast 0%, versus 0% previous.

- US Industrial Production for August 2022 (MoM) – Forecast 0.2%, versus 0.6% previous.