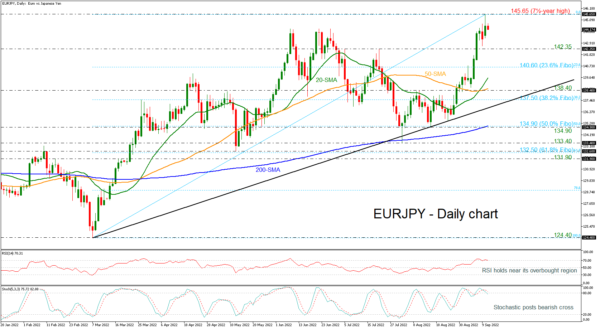

EURJPY skyrocketed to a fresh seven-and-a-half-year high of 145.65 on Monday’s sessions with the technical oscillator suggesting an overbought market.

The RSI indicator is turning lower near the 70 level, while the %K and the %D lines of the stochastic oscillator posted a bearish crossover, suggesting an extension to the downside in the short-term timeframe. However, the 20- and 50-day simple moving averages (SMAs) created a bullish cross and the price is still developing well above them and the uptrend line.

Should the price extend declines, the 142.35 support and the 23.6% Fibonacci retracement level of the up leg from 124.40 to 145.65 at 140.60 could be the next levels to have in mind. Below that, the focus could shift straight to the SMAs between 139.63-138.40. If the latter permits for further weakness, the next stop could be around the long-term ascending trend line and the 38.2% Fibonacci of 137.50.

On the other hand, a move back to the upside could retest the multi-year high at 145.65 before attention turns to 149.75, registered in December 2014.

Turning to the medium-term picture, the bullish outlook came back into play after the bridge of the previous highs. For a bull market though traders need to wait for a clear close above 145.65.

Overall, EURJPY holds a bullish profile both in the short and the medium-term.