Key Highlights

- EUR/USD started an upside correction above the 1.0000 level.

- It broke a key bearish trend line at 0.9985 on the 4-hours chart.

- GBP/USD is attempting a recovery wave from the 1.1400 zone.

- USD/JPY corrected lower after trading to a new multi-year high at 144.99.

EUR/USD Technical Analysis

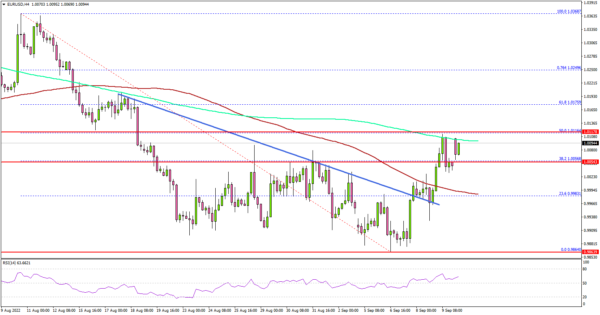

The Euro started a decent recovery wave from the 0.9864 low against the US Dollar. EUR/USD cleared the 0.9920 and 0.9950 resistance levels to move into a short-term positive zone.

Looking at the 4-hours chart, the pair was able to clear the 1.0000 resistance zone and a key bearish trend line at 0.9985. The bulls pushed the pair above the 23.6% Fib retracement level of the downward move from the 1.0368 swing high to 0.9864 low.

It is now trading above the 1.0050 level and the 100 simple moving average (red, 4-hours), but it is still below the 200 simple moving average (green, 4-hours).

The pair is now facing resistance near the 1.0120 zone and the 200 simple moving average (green, 4-hours). The 50% Fib retracement level of the downward move from the 1.0368 swing high to 0.9864 low is also acting as a resistance.

If the bulls remain in action, the pair could even clear the 1.0120 resistance. The next major resistance is near 1.0175, above which the pair may perhaps rise towards the 1.0220 level. The main hurdle sits near the 1.0350level.

If there is a fresh decline, the pair might find bids near the 1.0000 level. A downside break below the 1.0000 support might increase selling pressure. The next major support is near the 0.9950 level, below which the pair could even test the 0.9880 level. Any more losses might send USD/JPY towards the 0.9850 support.

Looking at GBP/USD, the pair found support near the 1.1400 zone and recently started an upside correction towards the 1.1600 zone.

Economic Releases

- UK Industrial Production for July 2022 (MoM) – Forecast +0.4%, versus -0.9% previous.

- UK Manufacturing Production for July 2022 (MoM) – Forecast +0.6%, versus -1.6% previous.