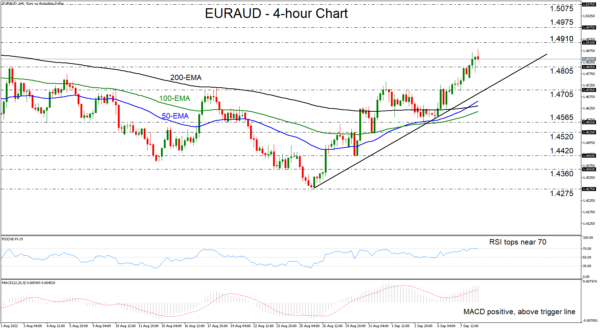

EURAUD has been in a rally mode since Tuesday, when it hit support slightly above the 50- and 100-period exponential moving averages (EMAs), thereby allowing the drawing of an upside support line from the low of August 26. Today, the pair emerged above the 1.4805 barrier, marked by the high of August 2, while the price action remains one of higher highs and higher lows, suggesting that the short-term bias remains bullish.

Both the RSI and the MACD detect upside speed, with the former lying near 70 and the latter running above both its zero and trigger lines. That said, the RSI is showing signs of topping, highlighting the risk of a small setback before the next bullish march.

The bulls could take the reins from somewhere above the aforementioned upside line, and perhaps aim for the 14910 zone, which acted as a temporary ceiling between July 12 and 21. If it doesn’t hold this time around, its break could see scope for extensions towards the high of July 11 at 1.4975, or even the 1.5075 hurdle, marked by the inside swing lows of June 30 and July 5.

On the downside, the bullish case may be scrapped upon a break below 1.4565. The pair would not only be below the upside line, but also below all the moving averages. After that, initial support may be found at 1.4520, the break of which could pave the way towards the low of August 30 at around 1.4420.

In brief, EURAUD has been trending north since August 26, as marked by an upside support line. Combined with the fact that the pair is also trading above all the plotted moving averages, this suggests that the path of least resistance remains to the upside.