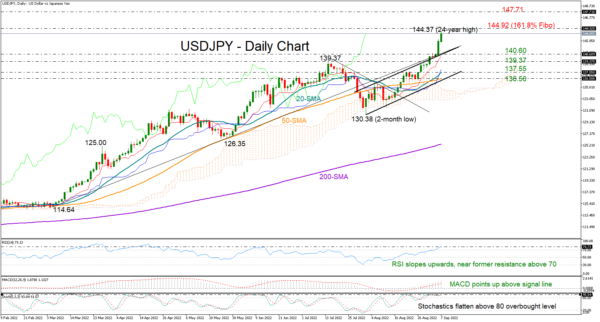

USDJPY is trying to repeat Tuesday’s exciting rally after re-activating its long-term uptrend above July’s peak of 139.20 last week, boosting the price up to 144.37 early on Wednesday– the highest since August 1998.

The area around 144.37 was somewhat constraining back in 1998, while the 161.8% Fibonacci extension of July’s bearish correction is within a breathing distance at 144.92 too. Hence, some congestion cannot be ruled out within this area. Note that the RSI and the stochastics are comfortably above their overbought levels and near a former resistance zone, suggesting that the bears might be around the corner. If buying appetite strengthens instead, the ascend could see further continuation towards the 1998 top of 147.71.

Should traders engage in profit taking soon, the pair could revisit the broken bullish channel seen around 140.60. A move lower from here may immediately take a breather around July’s peak of 139.37 before stretching towards the 20-day simple moving average (SMA) at 137.55. If downside forces persist, the door will open for the 50-day SMA and the channel’s lower boundary around 136.50.

All in all, USDJPY is back in a bullish trend after almost two months, with the rally expected to continue up to 147.71 unless the area around 145.00 proves tough to overcome.