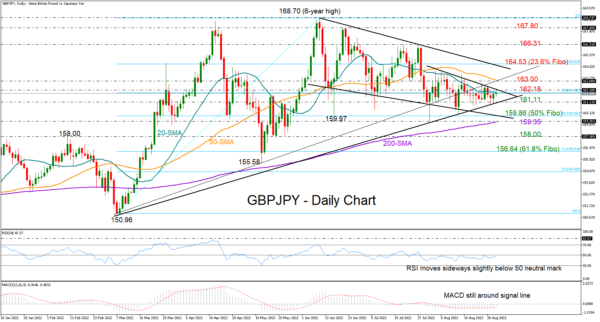

GBPJPY has been congested under its 20-day simple moving average (SMA) for more than a month now despite receiving strong defense from the March ascending trendline.

From a technical perspective, the bulls seem to be lacking incentive as the RSI keeps flattening just below its 50 neutral mark and the MACD remains stable around its red signal line and below zero.

Perhaps a clear break above the 162.18 – 163.00 area, which encapsulates two trendlines, the 50-day SMA, and the 38.2% Fibonacci retracement of the 150.96 – 168.70, is needed to motivate an acceleration towards the surface of the bearish channel at 164.53. Note that the 23.6% Fibonacci is also positioned here. A decisive close above it could brighten the short-term outlook, likely bolstering upside forces up to July’s resistance at 166.31.

On the downside, a close below the March trendline at 161.11 could aggressively pressure the price towards the channel’s lower boundary seen around the 50% Fibonacci of 159.86. Should the 200-day SMA at 159.35 give the green light to the bears too, the pair could dive towards the 158.00 round level, a break of which would downgrade the neutral medium-term trajectory.

In brief, GBPJPY is maintaining a neutral-short-term bias. A move above 162.18 or below 161.11 is likely needed to generate some volatility in the market.