WTI oil price is down for the second day and probes below $90 level, under renewed pressure from rising concerns about the state of global economy, rise in OPEC oil output in August to the highest since early period of pandemic in 2020 and s slowdown in the activity in China’s manufacturing sector, due to restrictions on the latest Covid outbreak that all contribute to growing concerns about global demand.

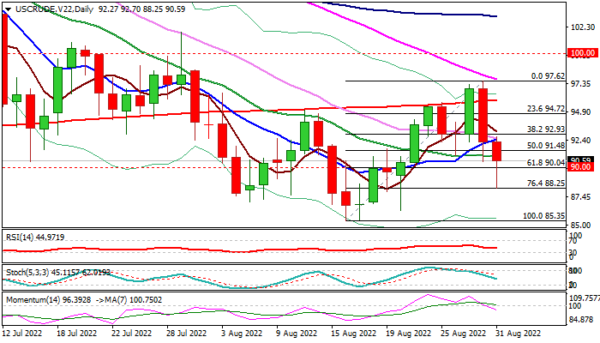

Weakening structure in daily technical studies, as falling 14-d momentum indicator moved into negative territory and formation of a bull-trap on a false break above 200DMA and Tuesday’s formation of bearish engulfing pattern, add to negative signals.

Cracked $90 round-figure support also marks Fibo 61.8% of $85.35/$97.62 upleg, with close below here to confirm reversal and open way for retest dented $88.25 support (Fibo 76.4%) and risk drop to seven-month low at $85.35 (Aug 16 low).

Near-term action should stay below daily Tenkan-sen ($91.94) to keep bears intact.

Res: 91.48; 91.94; 92.70; 92.93

Sup: 90.00; 88.25; 87.00; 86.27