EUR/USD

On Tuesday, the single European currency failed to breach the formed range. The day started off calmly, but trading intensified at around 07:00 GMT after the release of the German preliminary inflation data.The news was taken positively and the bulls managed to breach the key level of 1.0000. The pair continued higher, but the bull attack was eventually stopped by the newly formed resistance at 1.0054. After the U.S. data at 14:00 GMT, we saw a correction due to the stronger dollar and the market finished at around 1.0014. Today, from 03:00 to 06:00 GMT, we will see a number of data on the economic state of the EU, the inflation in France, as well as the change in new jobs for Germany. Whether the currency pair will be able to break out of its range will depend on how this data will be interpreted and what actions the ECB will take following its release.

USD/JPY

A new day, a new high for the Ninja. We continue to see a strong uptrend, characterised by the consecutive breach of resistances and the formation of new highs, with the pair finding itself as high as 139.06 yesterday. The dollar continues to flex its strength against a number of currency pairs, but this trend is most prevalent when it comes to the USD/JPY. On Tuesday, we saw unemployment in Japan remaining at the expected levels, but that wasn’t enough for traders to favour the yen over the dollar. The strong consumer confidence data and private sector job openings positively influenced the dollar and the currency pair peaked 30 pips higher than yesterday’s top. Movements in the currency pair are expected to be dictated by the U.S. private non-farm payrolls data today at 12:15 GMT. For now, there is no expectation for the trend to change, but such a scenario should still not be ruled out completely.

GBP/USD

Tuesday got off to a promising start for the Cable – with an extension of the upward moves that began on Monday this week. We saw a breach at 1.1726 after the UK money flow data pushed the bulls to attack, as well as a new weekly high at 1.1757. There, however, the bears did not wait to make a fresh entry, and following the release of the consumer confidence and private sector job openings data at 14:00 GMT, initiated an attack of their own with the help of the stronger dollar. As a result, the dollar continued its rise and the pound dived to a new monthly bottom at 1.1618. Price action today is expected to continue to be dictated by the strength of the dollar, with everyone waiting on the information surrounding the job openings in the U.S. at 12:15 GMT today. Whether the pound will seek a new bottom will depend on whether the released data can provoke a new wave of purchases.

EUGERMANY40

The positive German data, that came out yesterday morning, seemed to push the bulls to attack, resulting in a new weekly high of 13156. However, the start of a corrective move did not take long, and after the opening of the U.S. session, the EUGERMANY40 reached the support formed at 12879. The index managed to stabilise there and finish the day at around 12926. Today at 6:00 GMT and 7:55 GMT, we will be expecting data on import prices and the change in unemployment for Germany, both of which may spur traders to go on the offensive. The likelihood of the pressure continuing and the trend deepening is high, but moves in the opposite direction should not be ruled out as well.

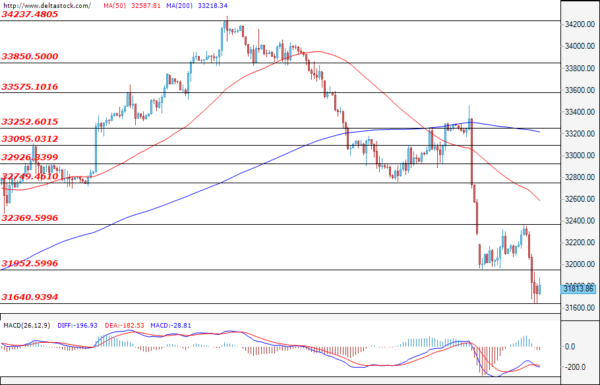

US30

Yesterday, the session for the blue-chip index started promisingly – with an extension of the uptrend that continued on Monday after filling its gap. Shortly before Wall Street opened, the index hit a new weekly high of 32.369, but after the U.S. open, the bears took complete control of the market. Following yesterday’s release of the strong dollar data at 14:00 GMT, the index breached the previous support at 31952 and formed a new low at 31640. There, the market stabilised and ended the trading session at around 31814. Today, the non-farm employment change data for the U.S. at 12:15 GMT may deepen the trend in the U.S. indices and we may see a new bottom. However, in a bear market, it is good to remember that while upward corrections are often sizable and appeal lucrative, they tend to be short-lived.