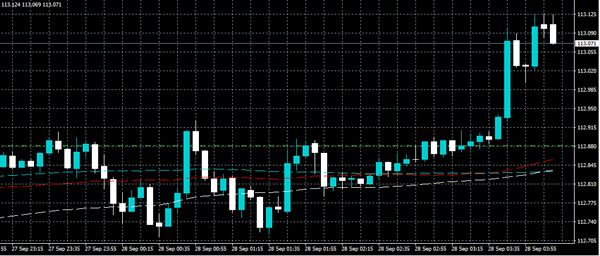

The USDJPY pair continues to trade at an 11-week high around the 113 level, as Japanese politics and a stronger U.S dollar help to lift the pair. Japanese parliament was earlier dissolved in time for a snap election, which is widely speculated to be held on October 22nd.

Given the recent strength in the U.S dollar and the uncertainty surrounding the Japanese election, the expectation is for the USDJPY pair to remain bullish in intraday trading.

From a technical perspective, the USDJPY pair will remain strongly bullish, while trading above the former weekly price high, at 112.71.

A clear break above the current monthly high, at 113.25 should encourage USDJPY buying interest towards the July 14th swing high, at 113.57.

Key USDJPY technical support is currently located at 112.89 and the 112.71. Below 112.71 the pair risks further intraday losses towards 112.57 and 112.23.

To the upside, key intraday resistance above the current monthly price-high is found at 113.57 and 113.80. Above 113.80, price further resistance is found at 114.10 and 114.49.

.