Key Highlights

- USD/JPY started another increase above the 136.00 resistance zone.

- It broke a major bearish trend line at 134.40 on the 4-hours chart.

- EUR/USD and GBP/USD are struggling to start a recovery wave.

- The US GDP contracted 0.6% in Q2 2022 (Preliminary).

USD/JPY Technical Analysis

The US Dollar started a steady increase from the 132.00 zone against the Japanese Yen. USD/JPY broke many hurdles near 133.50 and 134.00 to move into a positive zone.

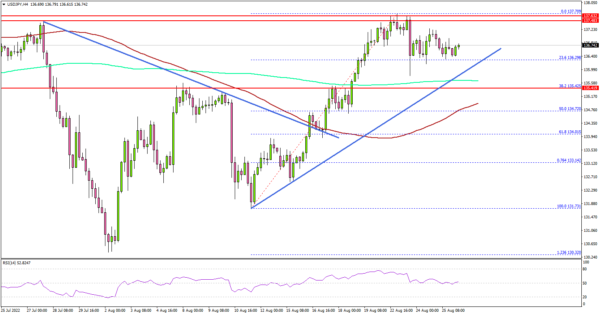

Looking at the 4-hours chart, the pair settled above the 135.00 zone, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours). The pair even broke a major bearish trend line at 134.40.

It opened the doors for a decent increase above the 136.00 and 136.50 levels. The pair traded close to the 138.00 resistance and formed a high near 137.70.

Recently, there was a downside correction below the 137.20 level. The pair even dipped below 136.00, but downsides were limited. The pair stayed well above the 135.50 support and the 200 simple moving average (green, 4-hours).

If there is a downside break below the 135.50 support, the pair could decline towards the 134.80 support and the 100 simple moving average (red, 4-hours).

Conversely, the pair might rise again above 137.40. On the upside, the pair is facing resistance near the 138.00 level. The next major resistance is near the 139.40 level. A clear move above the 139.40 resistance might send the pair higher towards the 140.00 level and to a new multi-year high.

Fundamentally, the US Gross Domestic Product report for Q2 2022 (prelim) was released yesterday by the US Bureau of Economic Analysis. The market was looking for a drop of 0.8% in the GDP.

The actual result was better than the forecast, as the US GDP contracted 0.6% in Q2 2022, up from the last reading of -0.9%.

Looking at EUR/USD, the pair is consolidating near the parity level and might extend losses. Similarly, GBP/USD remains at a risk of more downsides.

Economic Releases

- US Personal Income for July 2022 (MoM) – Forecast +0.6%, versus +0.6% previous.

- Jackson Hole Symposium.

- Federal Reserve Chair Jerome Powell testifies before Congress.