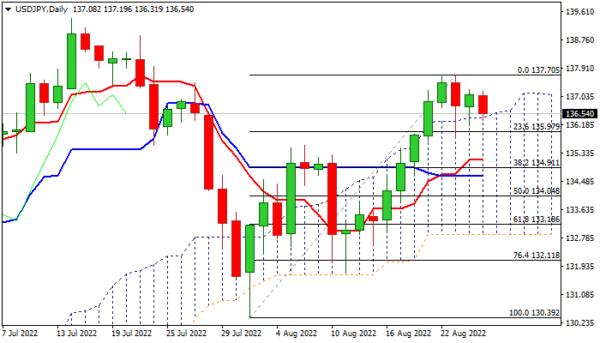

The dollar is a tad softer on Thursday and pressuring again strong support provided by the top of thick daily cloud, where strong downside rejections occurred in past two days.

Near-term action is maintaining firm bullish tone above the cloud and consolidation within the current range, following a double upside failure (Mon/Tue), is seen preceding fresh attempt through cracked Fibo 76.4% barrier (137.26) and retest of the most recent peaks (137.65/70) to signal bullish continuation towards key barrier at 139.39 (2022 high).

Daily studies are in full bullish configuration, though loss of bullish momentum warns that pullback may extend.

Scenario of penetration and close within daily cloud would weaken near-term structure and open way for deeper pullback towards 135 zone (daily Tenkan-sen / Fibo 38.2% of 130.39/137.70 upleg).

However, near-term action is likely to slow ahead of key event – Fed Chair Powell’s speech in Jackson Hole symposium that is expected be dollar’s main driver.

Majority bets on highly hawkish comments from Fed chief and decision for another 75 basis points hike in September, though many analysts expect that the US central bank slow the pace of tightening in coming months, due to encouraging signals from the latest US inflation report, but near-term decisions will highly depend on economic data.

Res: 137.24; 137.70; 138.87; 139.39

Sup: 136.40; 135.81; 135.55; 135.13