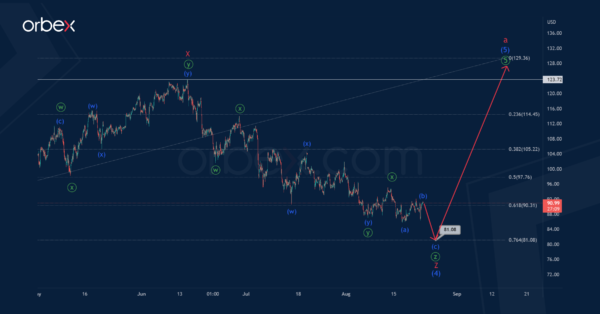

USOIL suggests the development of the final part of the global impulse wave a of the cycle degree.

The 1H timeframe shows the markup of the final primary wave ⑤, which takes the form of an intermediate impulse.

It is possible that an intermediate correction (4) in the form of a minor double zigzag was recently completed, then the price began to rise in the intermediate wave (5). It is assumed that the intermediate wave (5) will take the form of a standard minor impulse 1-2-3-4-5, as shown on the chart.

The end of the specified pattern is possible near 124.97. At that level, wave (5) will be at the 61.8% Fibonacci extension of impulse (3).

Let’s consider the second option, where the construction of an intermediate correction (4) can be continued. Perhaps it will have the form of a triple zigzag W-X-Y-X-Z.

The minor sub-waves W-X-Y-X look finished. Thus, in the near future, the downward movement is expected to continue in the actionary wave Z, which can be completed in the form of a minute triple zigzag ⓦ-ⓧ-ⓨ-ⓧ-ⓩ.

The oil price may fall to 81.08. At that level, intermediate correction (4) will be at 76.4% of impulse (3).

After reaching this level, the market is expected to grow above the maximum – 123.72.