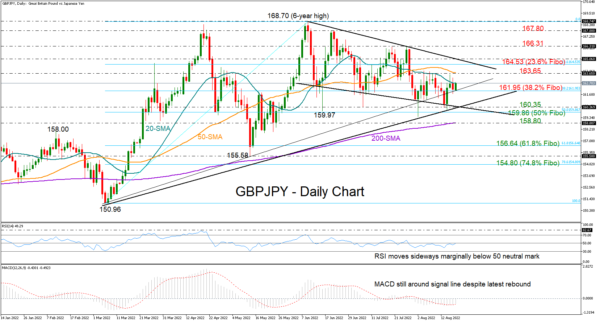

GBPJPY faced another rejection from the 20-day simple moving average (SMA) at 162.66 on Thursday, which has been capping bullish corrections since the start of the month, but the pullback was only mild, with the price immediately pausing around 161.95.

The momentum indicators remain cautious as the RSI keeps oscillating sideways marginally below its 50 neutral mark and the MACD has yet to distance itself above its red signal line. Having said that, as long as the safety net of 160.35 – 159.86 formed by two support lines and the 50% Fibonacci retracement of the 150.96 – 168.70 upleg holds, hopes for a new bull run are reasonable.

Should the pair close above the 20-day SMA, some consolidation could initially take place near the 50-day SMA at 163.65 before the door opens for the resistance line at 165.00. A sustainable move higher from here could then test the 166.31 barrier ahead of the 167.80 – 168.70 ceiling.

In the bearish scenario, where the price depreciates below 159.86, the 200-day SMA may first attract attention at 158.80. If the latter proves fragile, the decline may continue towards the key 61.8% Fibonacci of 156.64, a break of which could next take a breather somewhere between May’s low of 155.58 and the 78.6% Fibonacci of 154.80.

All in all, GBPJPY looks indecisive within the 162.66 – 161.95 territory at the moment. Any violation at the boundaries could navigate the market accordingly, though only a downfall below 159.86 or a rally above 165.00 would question the negative trend in the short-term picture.